TaxRM 0 2500. Resident individuals are eligible to claim tax rebates and tax reliefs.

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

12 rows The corporate tax rate is 25.

. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Income tax rates For tax residents in assessment year 2016. On the First 20000 Next 15000.

Income Tax in Malaysia in 2019. Principal hubs will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 effective from year of assessment 2016 for a period of five years with a possible extension for another five years. The 2016 Budget representing the first step of the 11th and final Malaysia Plan towards.

Resident companies are taxed at the rate of 25 reduced to 24 wef YA 2016 while those with paid-up capital of RM25 million or less are taxed at the following scale rates. Income tax rate be increased from 25 to 28. 8 provides a 100 percent income tax exemption for 10 consecutive years to an approved developer on statutory income derived from.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. The higher income classes in Malaysia on the other hand will experience an increase in the rate of income tax by 1 to 3 for individuals with chargeable income exceeding RM600000. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers.

The Tax tables below include the tax rates thresholds and allowances included in the Malaysia Tax Calculator 2019. 13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of 30 on total taxable income. Read Personal Income Tax Rebate and Personal Income Tax Relief for details.

CORPORATE INCOME TAX 12 Chargeable Income YA 2015 YA 2016 The first RM500000 20 19 In excess of RM500000 25 24. Promoted Double Taxation Agreement DTA If you are a tax resident of two countries you might end up having to pay taxes in both countries on the same income youve earned. Calculations RM Rate.

With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. The following incentives also will be available. Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia.

Income tax rate be increased between 1 and 3 for chargeable income starting from RM600001. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Chargeable Income RM Previous Rates Current Rates Increase 600001 1000000 25 26 1 Above 1000000 25 28 3 Non-resident individual taxpayer.

Resident companies with a paid up capital of MYR 25 million and. On the First 5000. The rental of a building located in an industrial park or a free.

An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia for 5 consecutive YAs. On the First 2500. Income tax exemption no8 order 2016.

On the First 50000 Next 20000. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. The disposal of land or building located in an industrial park or a free zone.

Choose a specific income tax year to see the Malaysia income. That does not control. Calculations RM Rate TaxRM A.

Income tax exemption no. You can find out more on the Inland Revenue Board of Malaysia website. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

You will notice that the final figures on that table are in bold. On the First 5000 Next 15000. Malaysia Income Tax Rates and Personal Allowances.

25 percent 24 percent from year of assessment ya 2016 special tax rates apply for companies resident in malaysia with an ordinary paid-up share capital of myr 25 million and below at the beginning of the basis period for a year of assessment provided not more than 50 percent of the ordinary paid- up share capital of the company is. On the First 35000 Next 15000. The current CIT rates are provided in the following table.

Thats because the rates for people who earn on that last two higher brackets have been increased from 25 to 26 and 25 to 28. Non-resident individuals Types of income Rate. YA 2016 onwards Changes to Tax Relieves.

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax when factoring in social security contributions pension contributions and other salary taxes in Malaysia. Lets look at the tax rates for the Year of Assessment 2016 and see how much you need to pay.

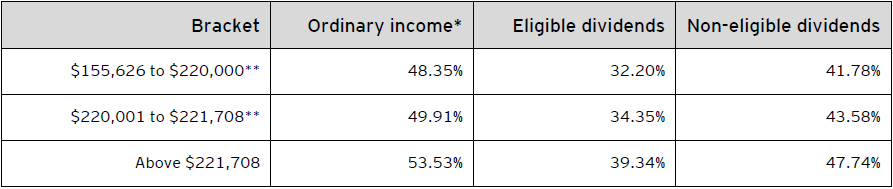

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

2016 Alberta Budget Capital Gains Tax Canada

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

World S Highest Effective Personal Tax Rates

Income Tax Malaysia 2018 Mypf My

Yemen Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Malaysia Tax Revenue 1980 2022 Ceic Data

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

Tax Guide For Expats In Malaysia Expatgo

Tax Guide For Expats In Malaysia Expatgo

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Thailand S New Personal Income Tax Structure Comes Into Effect Asean Business News

Malaysian Tax Issues For Expats Activpayroll

Personal Income Tax E Filing For First Timers In Malaysia Mypf My